Advanced Portfolio Design

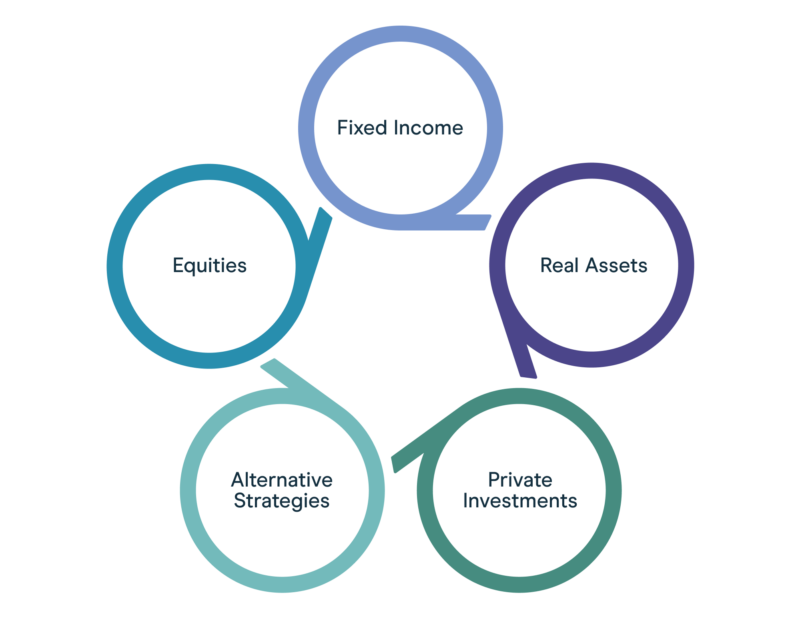

In designing our clients’ portfolios, we act as their outsourced Chief Investment Officer. We combine our deep investment expertise with the rigorous evaluation of Canadian and global third-party managers to craft sophisticated portfolios that go beyond conventional asset classes.

Our approach integrates the full spectrum of fixed income and public equity with strategies only available to affluent and ultra-affluent Canadians, such as hedge funds, private equity, private debt and private real estate opportunities.

Facing ever-increasing taxes, affluent families need to structure their portfolios to eliminate unnecessary tax drag. Unlike many mainstream portfolio managers, we pay particular attention to investment tax management. Because our clients face higher taxes, we design our portfolios with after-tax performance in mind.